Learning how to invest in the financial market can feel overwhelming at first. With so many options—from stocks and bonds to currencies and commodities—it’s easy to get lost.

But the truth is, anyone can start investing with the right knowledge, preparation, and strategy.

This guide will explain the basics of financial markets, how to start investing as a beginner, and practical tips to make smarter financial decisions.

The financial market is a global system where assets such as shares, bonds, currencies, and commodities are traded. It connects people who have money to invest with those who need funding.

For beginners, the key takeaway is this: the financial market provides opportunities to grow wealth over time, but it also comes with risks.

There are several reasons why people choose to invest in financial markets:

By investing, you make your money work for you instead of letting it lose value over time.

Buying shares means owning a part of a company. Stocks can grow in value and may also pay dividends.

Bonds are loans you give to governments or corporations in exchange for fixed interest payments. They are generally safer than stocks.

These investment funds allow you to diversify by pooling money with other investors. ETFs, in particular, are easy to buy and sell on the stock exchange.

Gold, oil, and agricultural products are traded on commodity markets. These are often used to hedge against inflation.

The forex market deals with currencies. It’s the largest market in the world but also one of the most volatile.

Before investing, take time to understand how markets work. Free resources, courses, and financial apps can help beginners.

Decide why you’re investing: retirement, building wealth, or short-term growth. Your goals will guide your strategy.

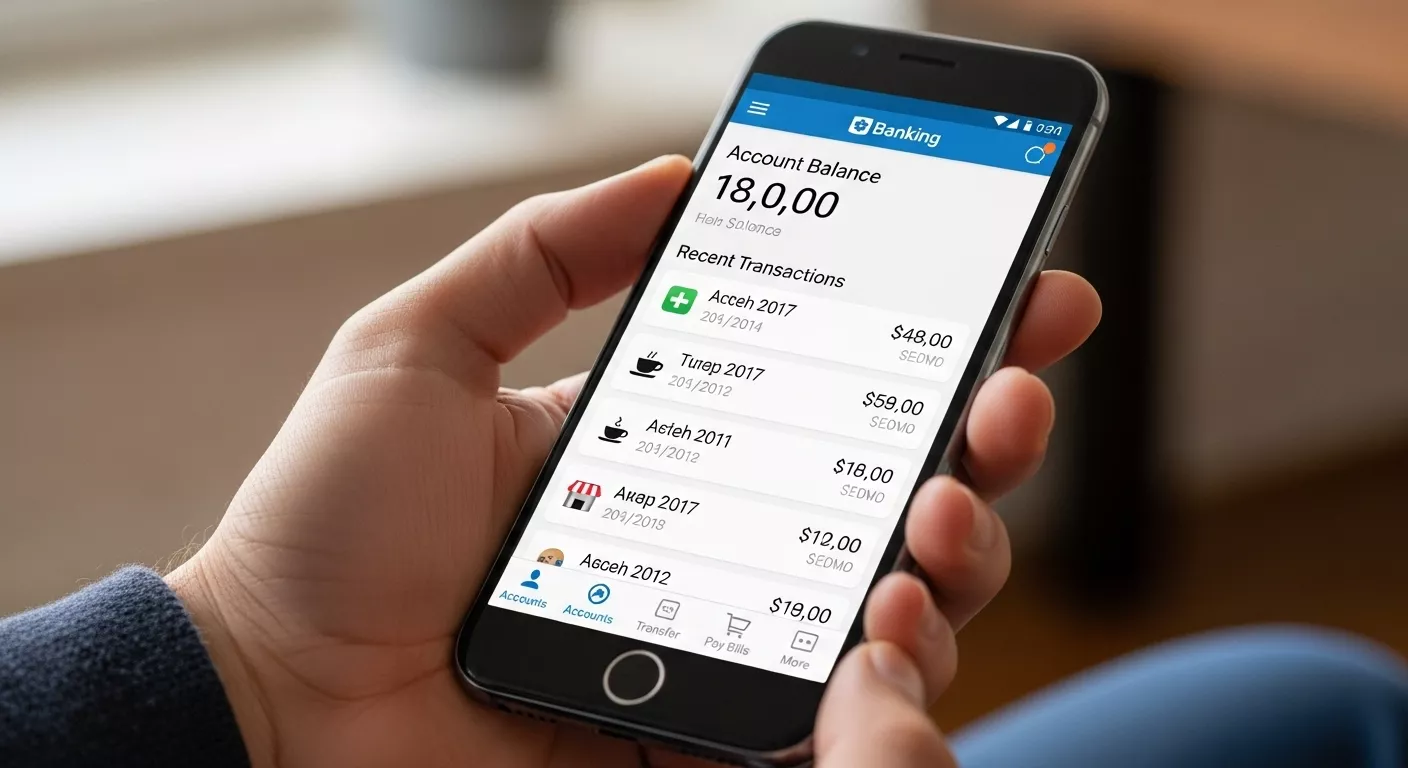

Online brokers and investment apps make it easy to open an account and start trading with small amounts.

Spread your investments across different assets to reduce risk. Never put all your money in one stock or market.

Begin with an amount you’re comfortable with. As you learn, you can increase your investments gradually.

While investing offers opportunities, it also carries risks:

That’s why education and discipline are crucial for long-term success.

Anyone can learn how to invest in the financial market. By starting small, setting clear goals, and building knowledge, you can turn investing into a powerful tool for financial security.

The secret is consistency: stay disciplined, diversify, and think long term. With the right mindset, the financial market becomes not just a place to invest money, but a pathway to achieving financial independence.