The CommBank financial market services give Australians one of the most trusted ways to invest in shares, ETFs, and global markets.

As the country’s largest bank, Commonwealth Bank offers not only everyday banking but also powerful investment tools through its CommSec platform, which is widely used by retail and professional investors.

This guide explains how CommBank helps Australians enter the financial market, how its platform works, and why it stands out as a leading choice.

Commonwealth Bank is the biggest financial institution in Australia, and its investment services are backed by decades of expertise. Through CommSec, CommBank offers:

For millions of Australians, CommBank is the first choice for stepping into the financial market.

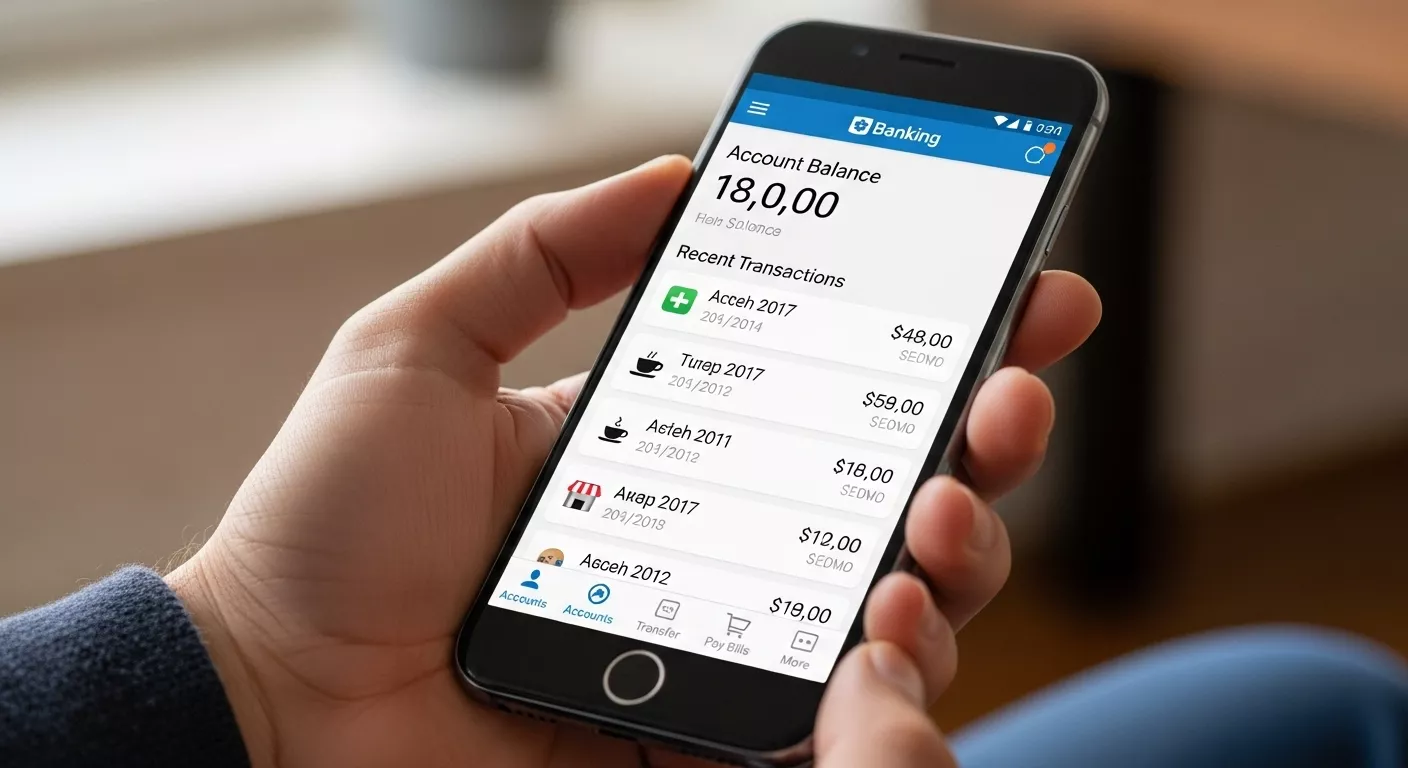

CommSec, Commonwealth Bank’s online trading arm, is designed to give investors all the tools they need in one place. Users can:

Available on desktop and mobile, the platform makes investing simple and accessible.

Register online using proof of identity and link your CommBank account.

Transfer money directly into your trading account.

Explore CommSec’s market insights to evaluate opportunities in shares, ETFs, or other assets.

Choose the asset, set your order, and confirm your transaction through the platform.

Use CommSec’s tools to review performance, diversify, and adjust strategies over time.

Even with a trusted bank like CommBank, the financial market comes with risks. Asset prices can rise or fall quickly, and no investment is guaranteed. Responsible investing means diversifying, setting clear goals, and staying disciplined.

The CommBank financial market services give Australians secure and accessible entry into investing. With the strength of Commonwealth Bank and the flexibility of CommSec, investors gain access to the ASX, international markets, and a wide range of investment products.

For beginners and professionals alike, CommBank offers the tools, education, and trust needed to succeed in the financial market and build long-term wealth.