The ANZ financial market services provide Australians with trusted tools to grow their wealth and access investment opportunities.

As one of the nation’s “Big Four Banks,” ANZ combines financial stability with modern platforms, making it a popular choice for both beginner and experienced investors.

This guide explains how ANZ supports investors in the financial market, the services it offers, and why it may be the right place to start your investment journey.

ANZ is well known for its strong presence in banking and wealth management. Through ANZ Share Investing, the bank gives customers direct access to the Australian Securities Exchange (ASX) as well as a wide range of investment products.

Key benefits include:

These features make ANZ a trusted entry point into the financial market in Australia.

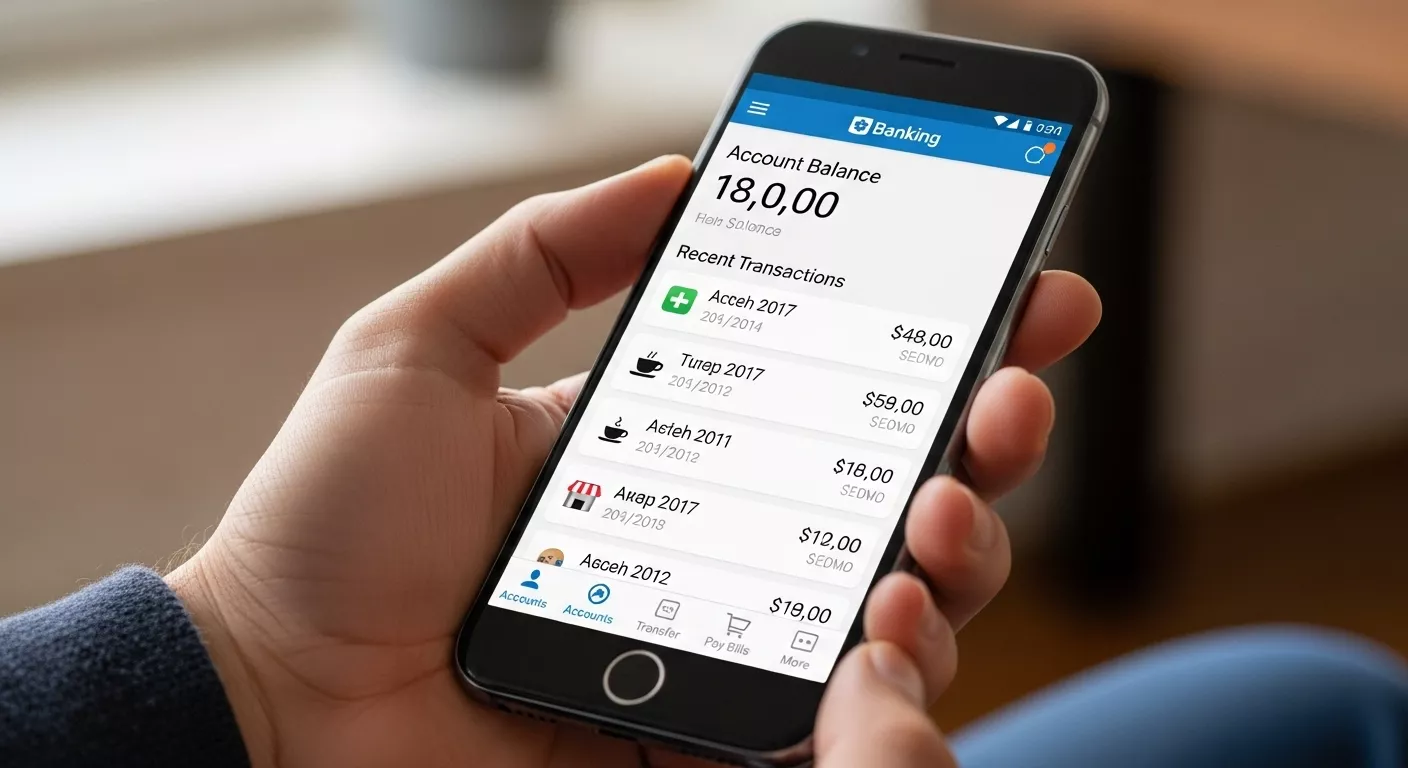

The ANZ online trading platform is designed to make investing simple and transparent. Users can:

The platform is available online and integrates easily with everyday ANZ banking.

Register online with proof of identity and link your ANZ bank account.

Deposit money to prepare for your first trade.

Use ANZ’s research tools to explore shares, ETFs, or managed funds.

Buy or sell securities through the online platform with clear and transparent fees.

Stay on top of your investments using the platform’s monitoring and reporting tools.

Even with a strong bank like ANZ, investing in the financial market carries risks. Market volatility, economic uncertainty, and global events can impact investment performance. Diversification and long-term strategies are key to reducing risk.

The ANZ financial market services provide Australians with a reliable, secure, and accessible way to invest. With a strong reputation, modern tools, and integration with banking services, ANZ makes it easier to enter and succeed in the world of investing.

For anyone starting their investment journey—or looking to expand—ANZ offers the trust of a major bank combined with the convenience of online trading, making it a solid partner in the financial market.