The financial market is the backbone of the global economy, influencing everything from interest rates and inflation to investment opportunities and personal savings.

Understanding how it works is essential not only for professional investors but also for everyday people who want to make better financial decisions.

This article will explain what the financial market is, how it operates, its main types, and why it matters for anyone looking to invest or manage their money effectively.

A financial market explained in simple terms: it is a platform where people, companies, and governments trade financial assets. These assets include stocks, bonds, currencies, and commodities. The market connects those who need money with those who have money to invest, making it a vital part of economic growth.

For example, when companies issue shares on the stock market, they raise capital to expand, while investors gain the chance to earn returns.

Financial markets work by bringing buyers and sellers together. Prices of assets are determined by supply and demand. When more people want to buy a stock than sell it, the price rises. When more people want to sell, the price falls.

Markets also reflect expectations about the economy. News about inflation, unemployment, or global events can influence investor behaviour, making the financial market highly dynamic and sometimes unpredictable.

There are different types of markets, each serving a unique purpose.

The stock market is where shares of companies are traded. It offers investors the opportunity to own part of a business and benefit from its growth.

In the bond market, governments and corporations borrow money from investors. Bonds are seen as more stable than stocks, offering fixed returns.

The forex market deals with currencies and is the largest financial market in the world. It’s where global currency values are determined.

This market trades raw materials like gold, oil, and agricultural products. Commodity prices often reflect broader economic trends.

Derivatives are complex contracts based on other financial assets. They are used for hedging risks or for speculative investments.

The financial market plays a crucial role in everyday life, even for those who don’t invest directly. It:

In short, a healthy financial market supports a healthy economy.

For beginners, entering the financial market may seem intimidating, but it can be simplified into clear steps:

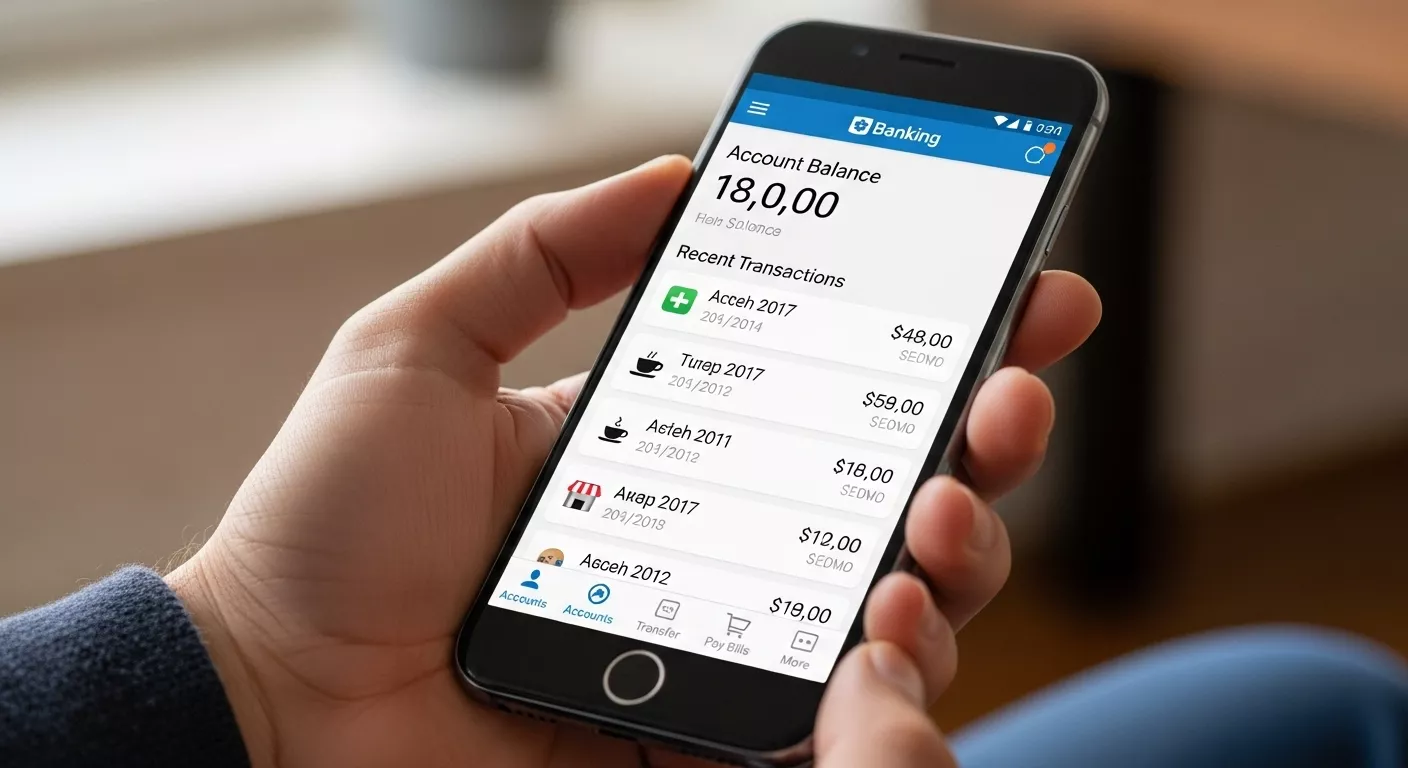

Financial apps and robo-advisors now make investing easier than ever, allowing users to access markets directly from their phones.

While financial markets offer opportunities, they also carry risks. Prices can fluctuate due to political instability, global crises, or changes in economic policy. Investing without understanding the risks can lead to losses.

That’s why research, education, and sometimes professional advice are essential before making major financial decisions.

These financial market tips help investors stay disciplined and focused on long-term results.

The financial market may seem complex, but at its core, it’s about connecting people who need capital with those who have it. By understanding how it works, recognising its types, and approaching it responsibly, you can unlock opportunities to grow your wealth and secure your financial future.

Whether you are a beginner or an experienced investor, the financial market is a space worth learning about—it is not just for Wall Street professionals, but for anyone who wants to make smarter financial choices.